How Does Personal Responsibility Affect Your Credit Report

If you have a current copy of your personal credit report simply enter the report number where indicated and follow the instructions provided. Aside from the inquiry performed when applying for a credit card the new account will soon show up on your credit report as an additional liability in your name.

21 Credit Repair Tools We Will Show You How To Use Credit Info Center Blog In 2022 Credit Repair Letters Credit Repair Credit Counseling

The age of your oldest account.

. How Can Personal Responsibility Affect Your Credit Record. Ultimately the best thing you can do is to be financially responsible including. Co-signing can make it harder for you to borrow for your own needs.

You can also get free copies of your credit reports from the three major credit bureaus. Negotiating and settling any outstanding issues. The good news is that a single.

Write a to do list of tasks or activities such as homework assignments chores and personal projects that must be done in the coming week. How much total debt you have. Credit utilization is the amount of available credit youre currently using in comparison to your credit limitboth on an individual card and multiple cards combined.

What are 3 things that can affect your. To dispute information in your personal credit report simply follow the instructions provided with it. If you change your name address telephone number or other personal information there are a few ways you can update your credit file.

Its vital to understand your legal obligations before entering into any kind of business contract or agreement that can affect your personal credit yet many business owners still misunderstand how their company finances can affect their personal finances. Length of credit history. Whether youve used an account recently.

Credit scores evaluate several criteria and co-signing will most likely affect your credit scores. In this instance any business debt will weigh even more heavily on your personal credit. Demonstrate to your merit badge counselor your understanding of time management by doing the following.

Credit reports and how personal responsibility can affect your credit report. A credit report completely free from late payments and derogatory marks can indicate to an employer that you have the financial maturity and general responsibility it takes to handle the position in question. Most companies keep sensitive personal information in their filesnames Social Security numbers credit card or other account datathat identifies customers or employees.

Ways to eliminate debt. Similarly unpaid utility bills can affect your credit score negatively when the debt is sold to a third-party debt collector. When you give permission for a landlord to request a copy of your credit report youve initiated a credit inquiry.

For information about COVID-19 head over to the Centers for Disease Control and Prevention. Not every employer will check your credit report but its important to be prepared. Your personal credit report includes appropriate contact information including a website address toll-free telephone number and mailing address.

Payment history debt-to-credit ratio length of credit history new credit and the amount of credit you have all play a role in your credit report and credit score. If you are asked for your Social Security number on an application for a credit card or a lease chances are your personal credit will be reviewed. The average age of your accounts.

However it is very rare that your business scores and ratings will have a great impact on your personal credit scores and. This could mean the difference between paying thousands of dollars versus tens of thousands when you borrow money to pay down your mortgage. The age of your newest account.

Does personal information affect credit score. While your personal information doesnt impact your credit scores it is an important part of your credit report that you want to keep up to date and accurate. To submit a dispute online visit Experians Dispute Center.

Under the Fair Credit Reporting Act FCRA you have the right to request a free report within 60 days if a company denies you credit based on the report. Because collections involve outstanding debts they can appear on your credit reports and do damage to your credit scores. For example the Amounts Owed category in your FICO credit score which makes up 30 of your score evaluates.

Beyond the signs of illegal activity your credit report can also tip off employers to a general lack of responsibility. However if sensitive data falls into the wrong hands it can lead to fraud identity. A personal loan that you repay in a timely fashion can have a positive effect on your credit score as it demonstrates that you can handle.

The most critical factor in determining your credit score is your ability to make your monthly payments. Learn more about Capital Ones response to COVID-19 and resources available to customers. In particular if you are a sole proprietor your personal credit may have a greater impact on your business.

It makes up 30 percent of. Even if your credit report is less than stellar dont fret. Paying bills on time.

This type of credit inquiry often referred to as a hard inquiry does affect your credit score. Personal credit report disputes cannot be submitted through Ask Experian. This information often is necessary to fill orders meet payroll or perform other necessary business functions.

You can get your credit report fixed if it contains inaccurate or incomplete information. Even when applying for a business credit card using an EIN your personal credit report is almost always used in making the decision and this does result in a hard inquiry on the report. A key to a good credit score is how well you manage the.

Your personal credit report includes appropriate contact information including a website address toll-free telephone number and mailing address. A variety of factors related to the length of your credit history can affect your credit including the following. The third-party collector can report the account to the credit bureaus.

Contact both the credit reporting agency and the company that provided the information to the CRA. By being responsible and paying your bills on time your credit report and credit score will be improved allowing for you to borrow money at lower interest rates.

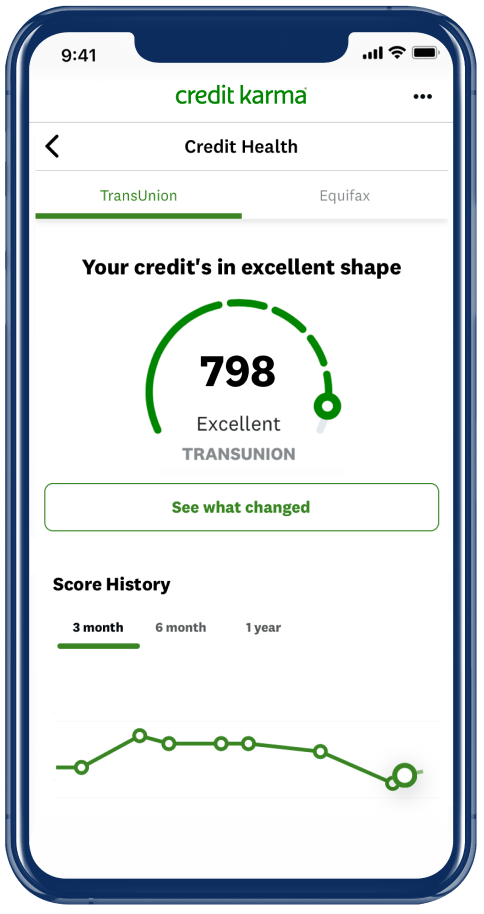

Credit History Impact On Your Scores Reports Credit Karma

Understanding Your Credit Consumer Information

Financial Responsibility In The United States Shrinkage Is Good What Is Credit Score Credit Score Credit Repair Companies

How To Remove Items From Your Credit Report In 2022 Money

Understanding Your Credit Consumer Information

An Open Letter To Dave Ramsey Part 2 Debt Management Credit Counseling Personal Budget

How To Remove A Charge Off From Your Credit Report Improve Credit Credit Score Improve Your Credit Score

Infographics Ever Wondered About The Unknown Charge On Your Card Here S How To Dispute That Char Credit Card Infographic Credit Card Charges Credit Dispute

Charge Off On Credit Reports What It Means And How To Fix It Credit Info Center Blog Credits Credit Report Charging

What Is A Good Credit Score And How To Fix Yours There Are Many Factors That Determine What Is A Good Credit Score Good Credit Good Credit Score Credit Repair

Divorce Credit Here S What You Need To Know Divorce Credit Score What Is Credit Score Credits

Why Did Your Credit Score Drop After Paying Off Debt Lexington Law

Why Did Your Credit Score Drop After Paying Off Debt Lexington Law

Why Can T I Get Out Of Debt Get Out Of Debt Debt Money Management

Personal Responsibility And Credit Capital One

How To Improve Your Credit Age Of Credit History Credit Com

The Road To Good Credit Credit Score Infographic Good Credit Credit Repair

Pin By Anika On Personal Loan Home Loan Credit Card Cibil Score Credit Score Bad Credit Score Check Credit Score

/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)

Comments

Post a Comment